refineware solutions

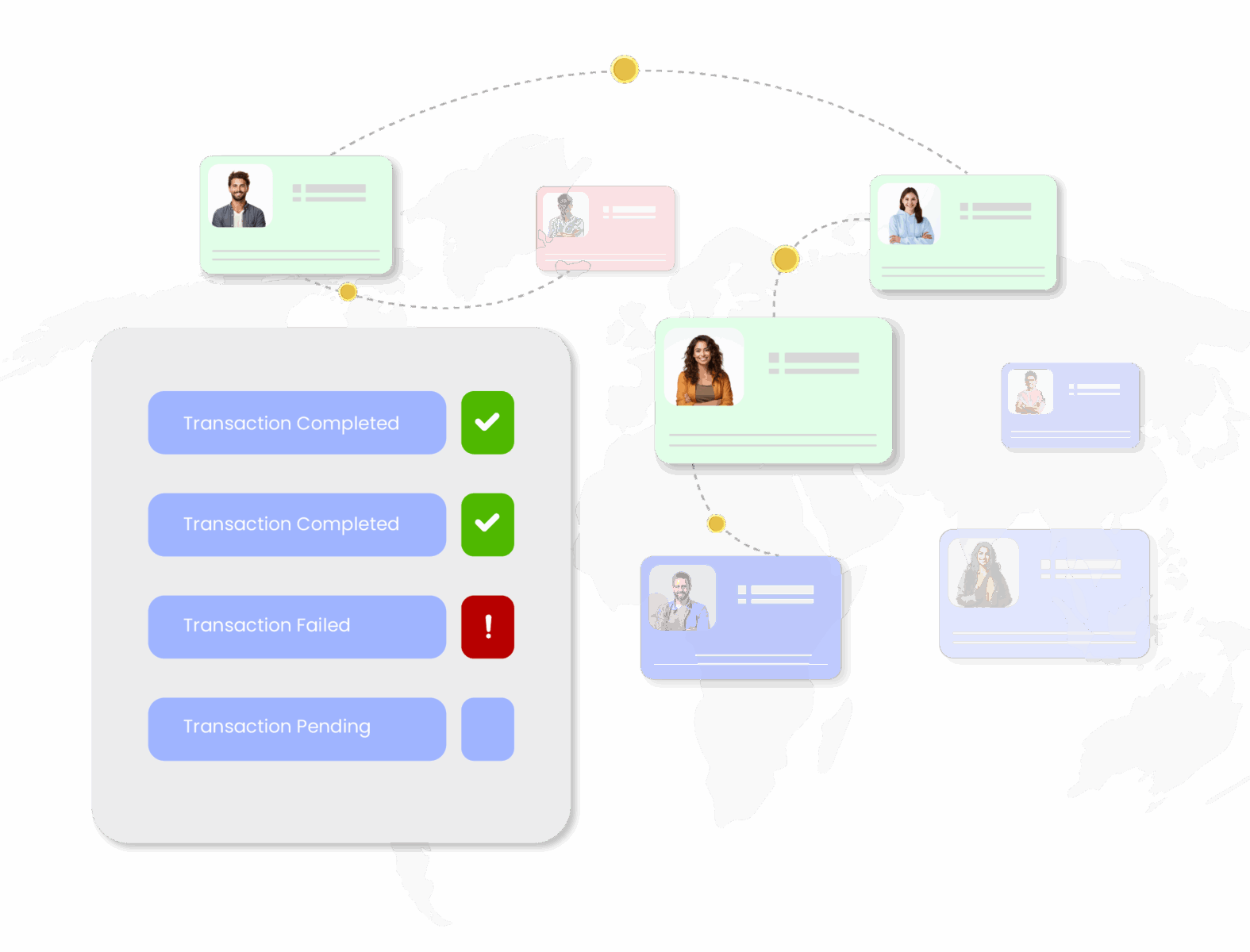

Transaction Monitoring

Payments are monitored with predefined rules.

Why You Should Transform Your Transaction Monitoring with Refineware

01

Zero-code transaction monitoring allows compliance officers to set up new monitoring rules without any coding skills. Alerts are generated in real-time and post-transaction based on these predefined rules.

02

The automated engine enhances operational efficiency and reduces errors in detecting suspicious activities. It can quickly process and verify a large volume of payments with accuracy.

03

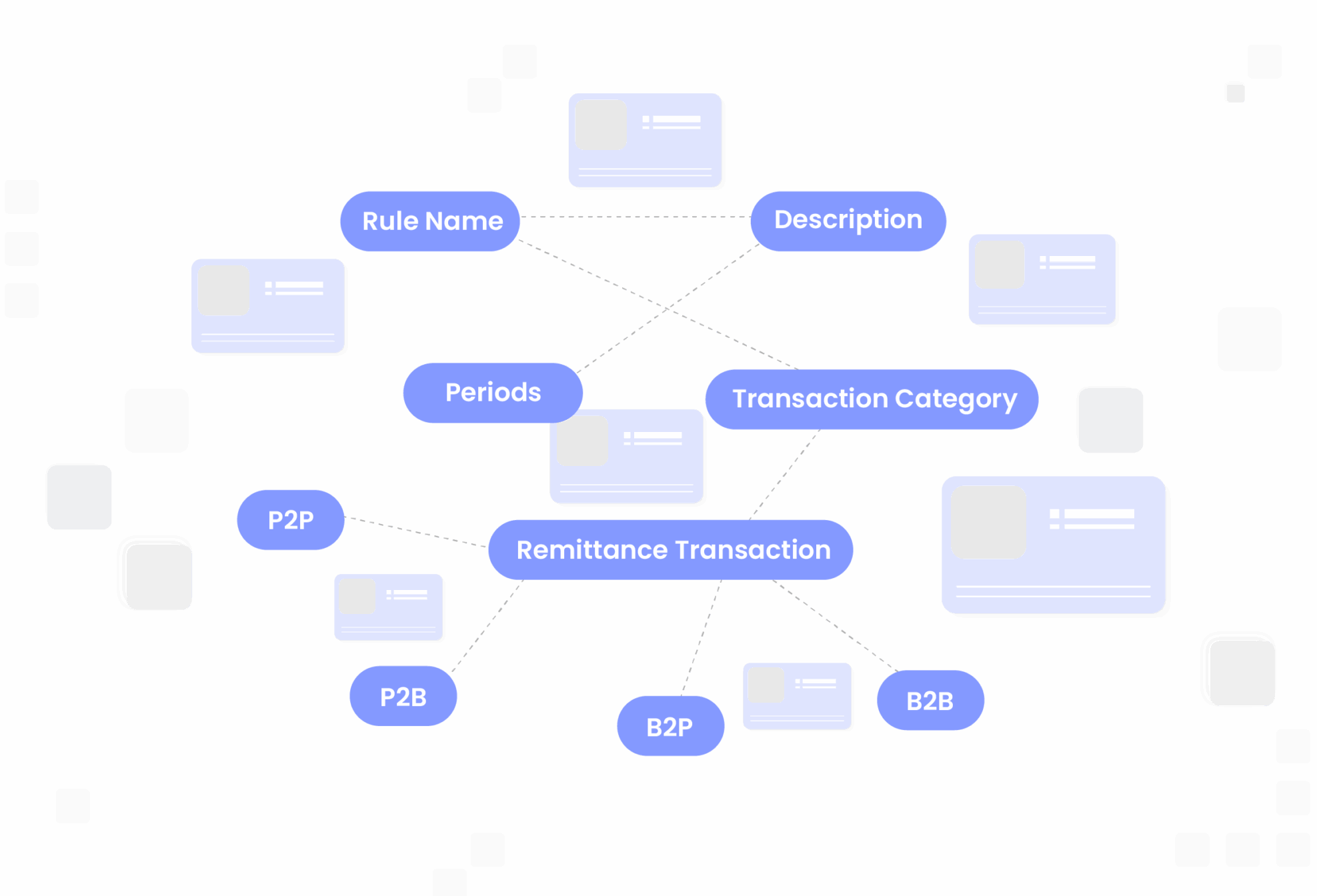

Rules are entirely configurable to match your organization’s policies. Parameters like frequency, thresholds, volume, transaction patterns, countries, beneficiaries, and products can be monitored, with alerts sent to a central console. Dynamic data visualization helps to accelerate decision-making processes.

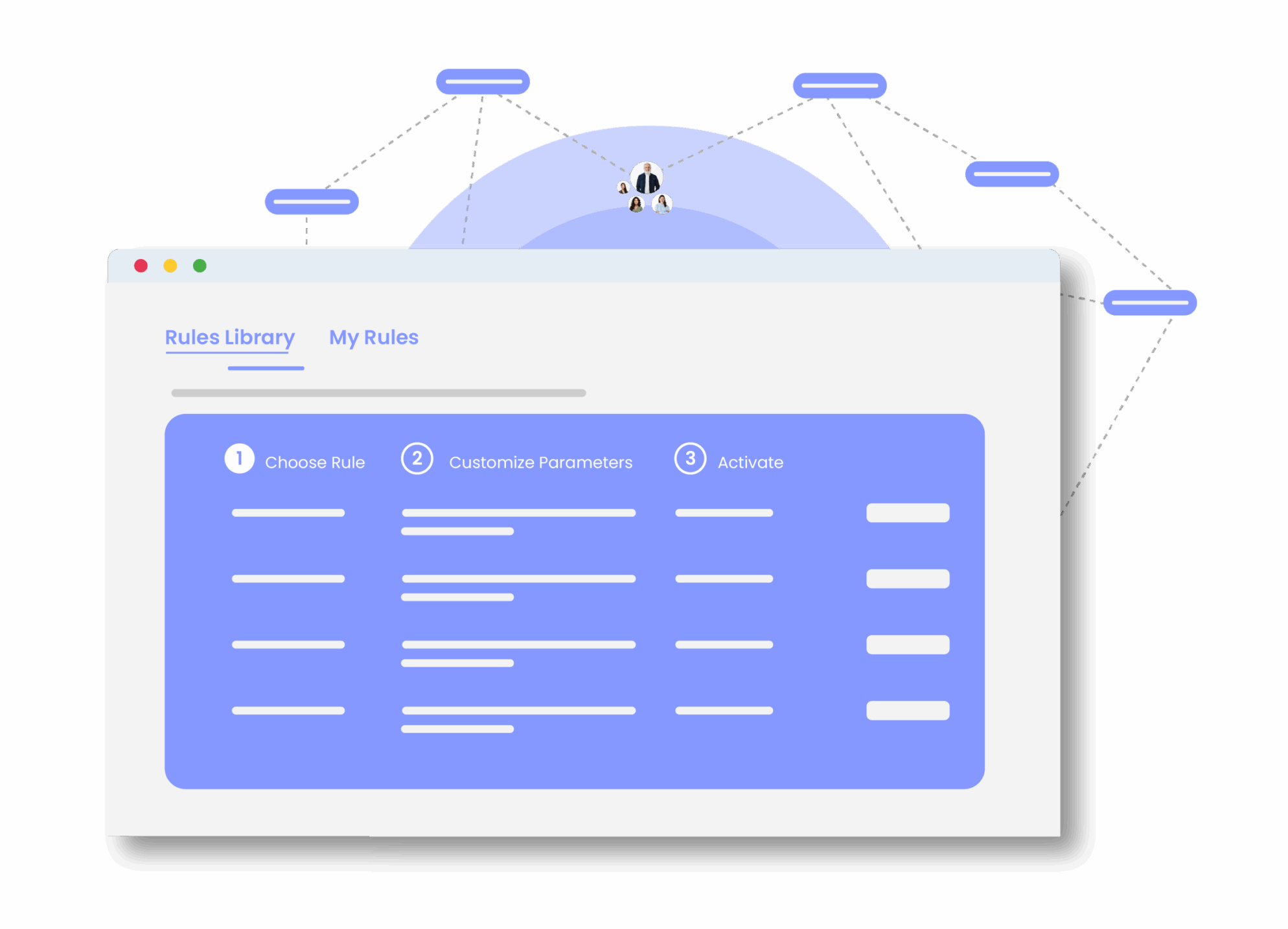

Zero-code rule building

200+ Rules

- Live Rules

- Post Rules

The easily configurable rule engine enables companies to quickly activate new transaction monitoring rules tailored to their business needs.

Create custom rules using built-in industry-specific transaction scenarios, organized by product type.

Alerts & Investigations

Alerts from live and post-transaction monitoring are managed through an integrated task management system and internal communications. All alerts and investigations are handled within the platform, with all related communications securely linked to the respective transaction and customer for easy future reference.

Dynamic Rules

Create customized rules based on products and transaction scenarios. Compliance officers can configure monitoring rules according to specific products and customer types.

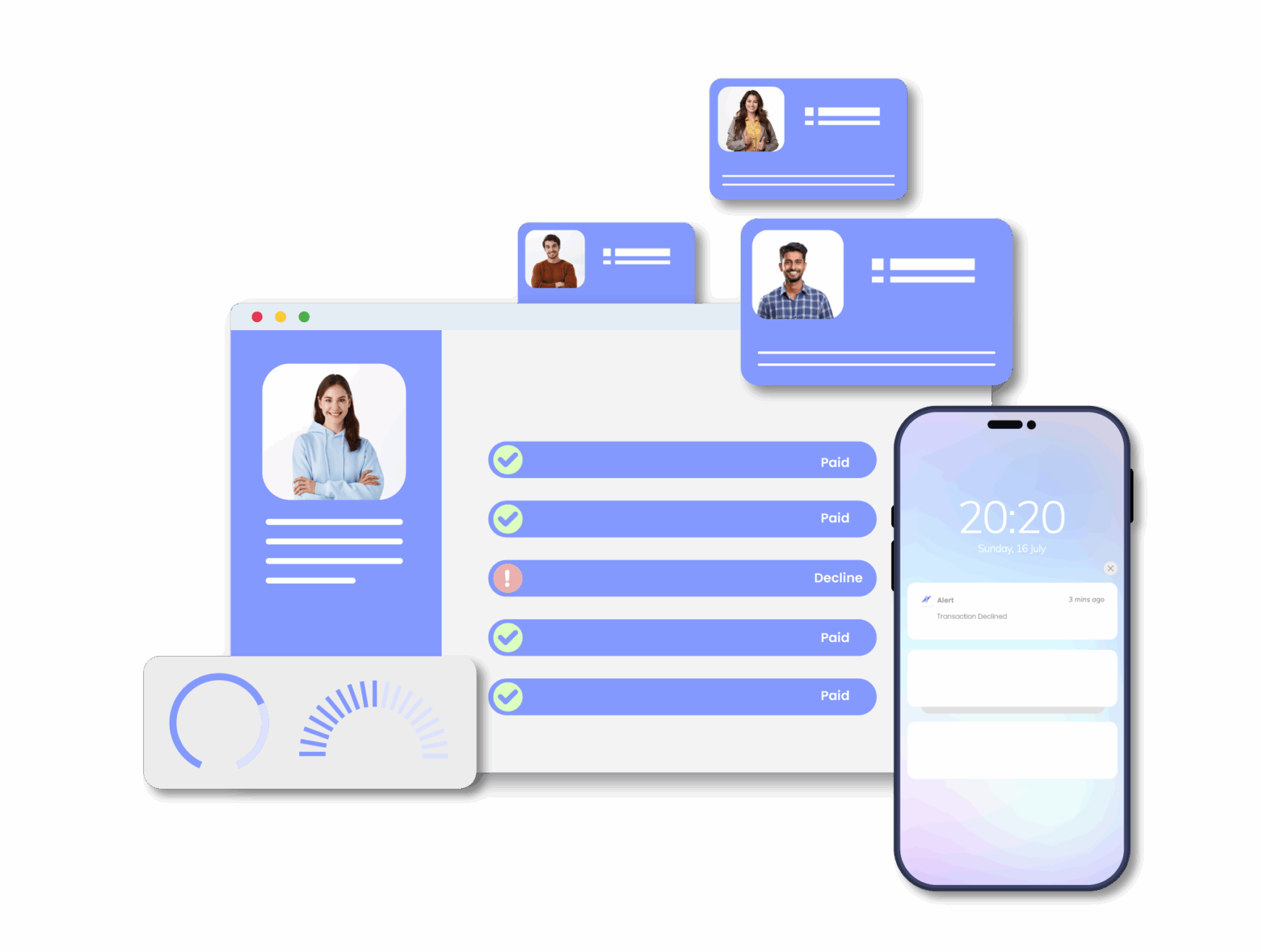

The flexibility to monitor transactions both live and post-transaction helps reduce false positives, allowing transactions to proceed while ensuring that alerts are promptly flagged for review.

Internal Communications

All communications and investigations related to transactions are managed through an integrated task management system, with records securely attached to each transaction for easy future reference.

A consolidated single-page view combining transaction details and customer history provides compliance officers with a clear overview, enabling quick recall and effective decision-making for further action.

Take Control of Every Transaction

We’d love to understand your transaction workflows and help you simplify every alert, rule, and risk.

Compliance made

smarter