refineware solutions

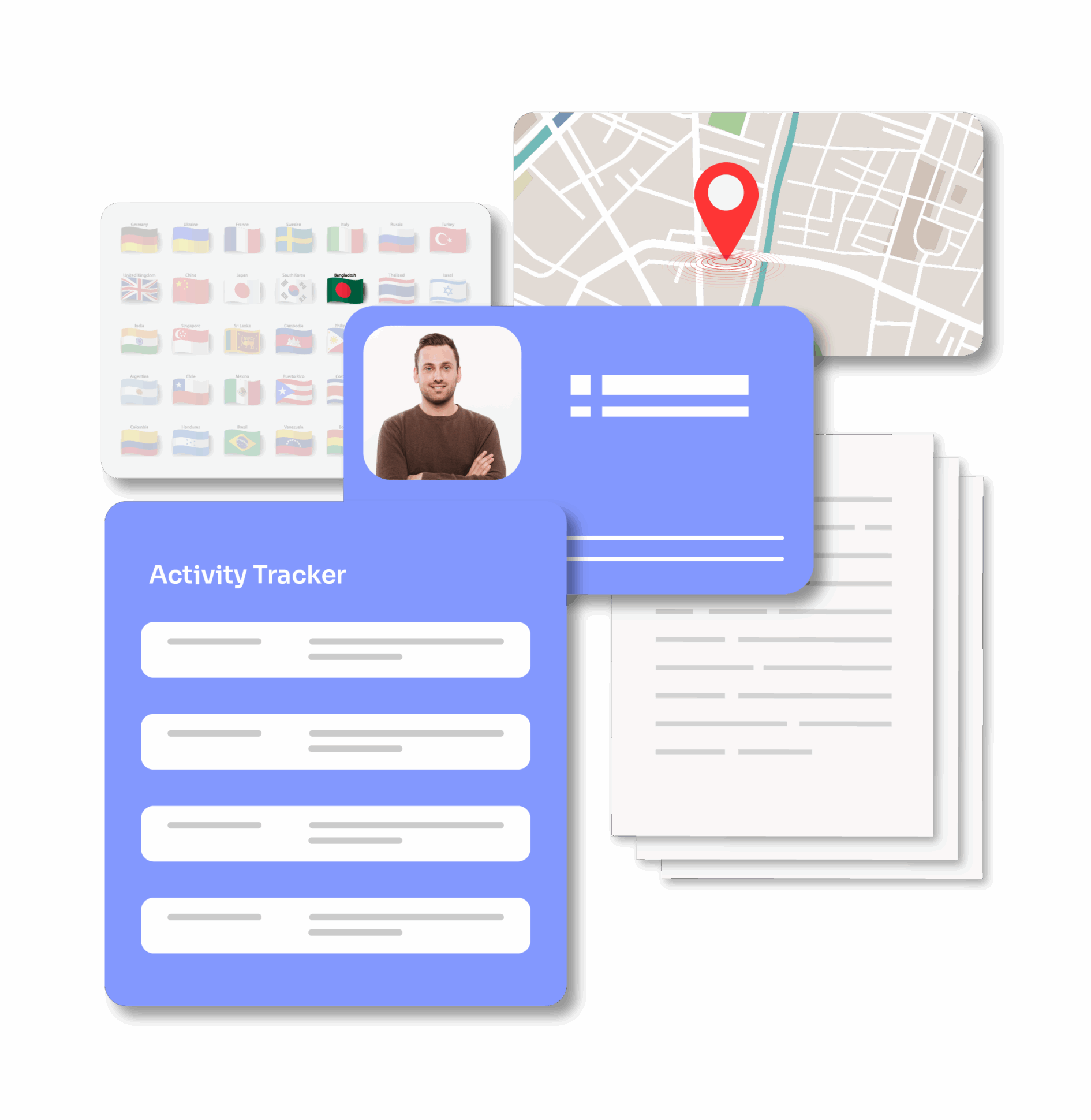

Payment Screening

Comprehensive Screening of Payments for Risk Detection and Control

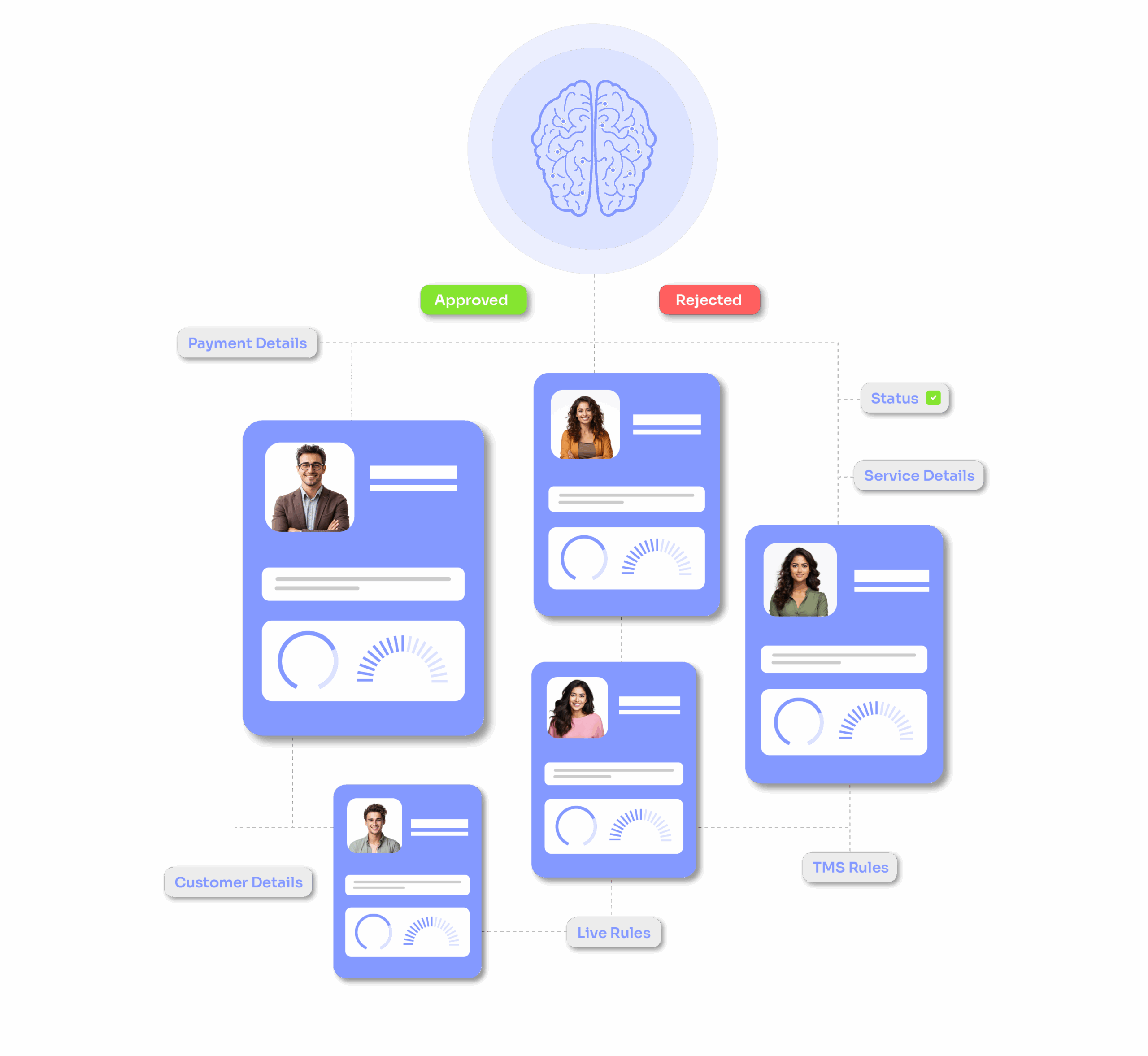

Payment Authorization

- Our zero-code rule engine lets you tailor rules easily to fit your compliance requirements.

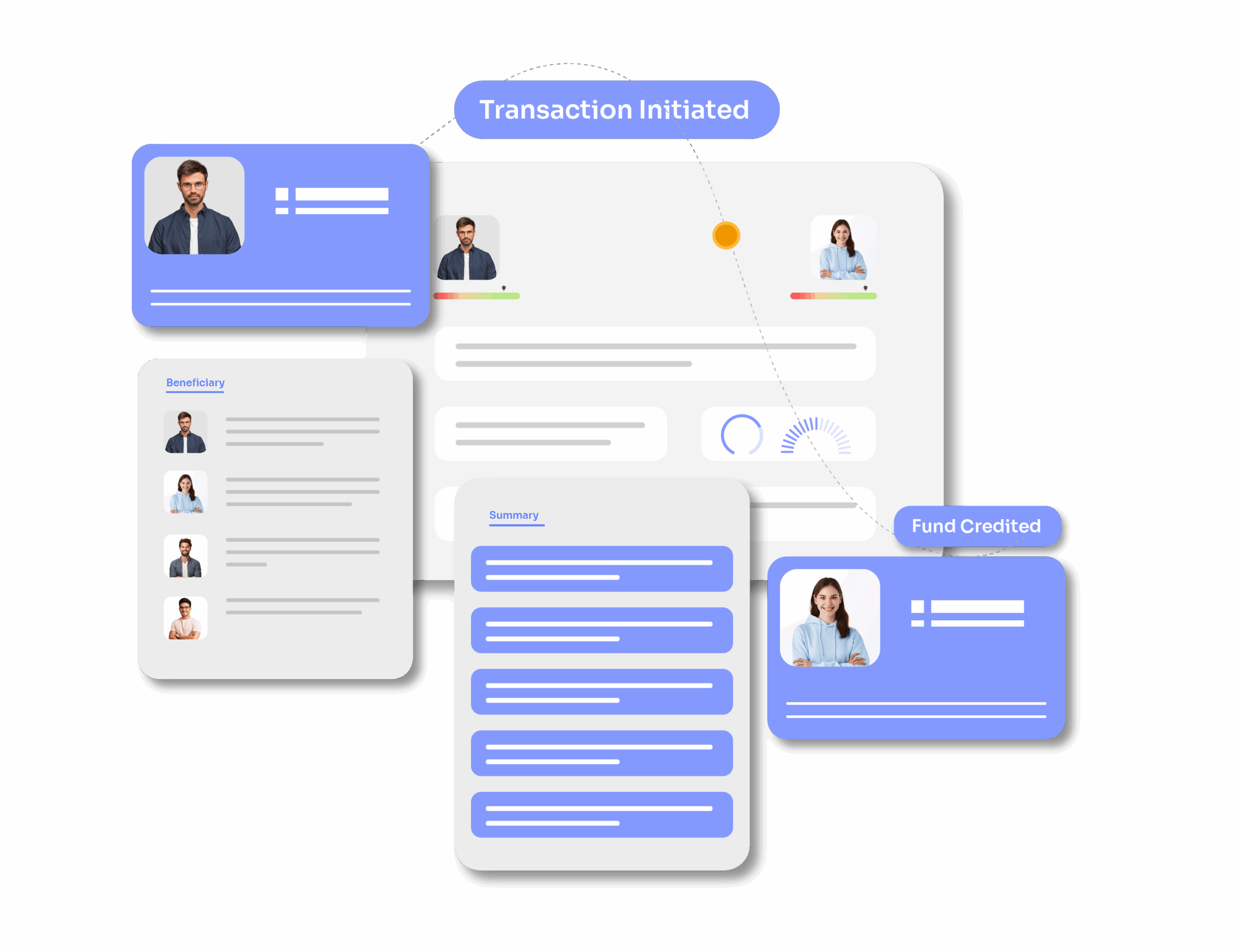

- Single-page transaction view with flagged rule alerts for easy processing.

- Create customer wise rule building to reduce false positives.

Customized Rules

Pre-configured industry rules cover 99.99% of customer transaction behaviors, enabling accurate flagging.

Compliance officers can easily build and deploy new rules as needed to address evolving situations.

Customer-specific rule creation helps reduce false positives, minimizing the compliance team’s workload.

Alerts and Case Management

Automated Alerts: Generate timely alerts for suspicious activities that require further review.

Investigation Tools: Provides comprehensive case management system for compliance officers to efficiently track, and investigate alerts.

Watchlist Screening

Sanctions Lists: Screen customers against national and international sanctions lists (eg: OFAC, EU, etc) to ensure compliance.

PEP Screening: Identify Politically Exposed Persons (PEPs) and their close associates to assess and manage elevated risk levels.

Whitelisting

Minimize false positives by effectively applying payment rules. Customize rules by product and customer helps to monitor transactions more accurately, allowing trusted transactions to be signed off and reducing unnecessary alerts in the future.

Screening Certificate

An automated screening certificate is generated for every processed transaction, documenting the screening checks performed along with any flags raised and approvals given during processing.

Payment Report

A dynamic reporting page provides a summary of payment history for quick insights. Integrated customer communications via email, WhatsApp, and SMS from the platform, makes faster and more efficient communication.

Empower Your Transactions with Trust

We’re here to help you secure your payment experiences with smarter screening.

Compliance made

smarter