Re-defining Compliance

Empowering Financial

Institutions to refine customers

& payments

Re-defining Compliance

Empowering Financial

Institutions to refine customers

& payments

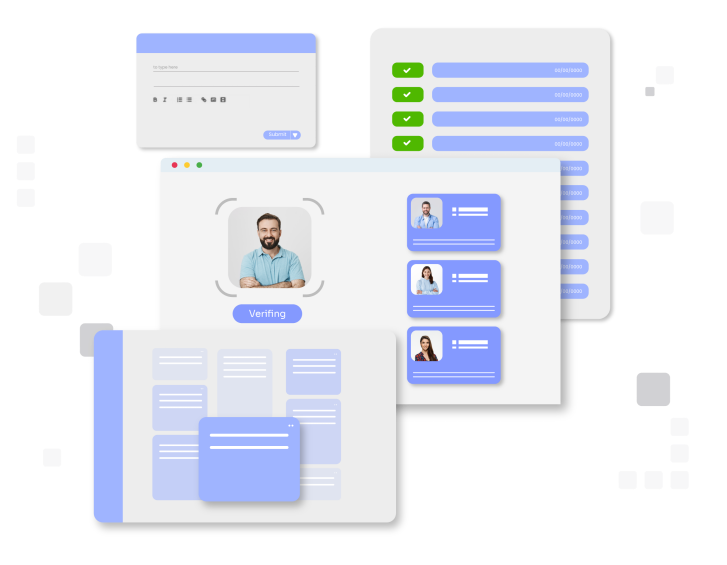

01 — Know Your Customer

Know Your Customer

Refineware enables financial institutions to digitize both individual and business customer onboarding in line with local and global regulatory requirements. Our platform is fully customizable and easily configurable to fit your specific industry needs, ensuring a smooth and compliant start for every customer.

01 — Know Your Customer

Know Your Customer

Refineware enables financial institutions to digitize both individual and business customer onboarding in line with local and global regulatory requirements. Our platform is fully customizable and easily configurable to fit your specific industry needs, ensuring a smooth and compliant start for every customer.

02 — Transaction Monitoring

Transaction Monitoring

A zero-code transaction monitoring engine comes equipped with 200+ pre-built rules to monitor payments and flag suspicious activities in real-time or post-event. An integrated task and case management module simplify internal communication, investigation and decisive action on payments.

02 — Transaction Monitoring

Transaction Monitoring

A zero-code transaction monitoring engine comes equipped with 200+ pre-built rules to monitor payments and flag suspicious activities in real-time or post-event. An integrated task and case management module simplify internal communication, investigation and decisive action on payments.

03 — Risk Management

Risk Management

Refineware uses advanced AI engine to continuously monitor customer behavior and risk profiles from onboarding to ongoing operations. Risk alerts are generated instantly as customer behavior or transaction patterns changes, ensuring your teams are always one step ahead.

03 — Risk Management

Risk Management

Refineware uses advanced AI engine to continuously monitor customer behavior and risk profiles from onboarding to ongoing operations. Risk alerts are generated instantly as customer behavior or transaction patterns changes, ensuring your teams are always one step ahead.

04 — Payment Screening

Payment Screening

Take control of your payment flows with customizable screening rules that adapt to your business needs. Get real-time alerts, automated case tracking, and built-in watchlist checks to spot risks before they occur. Reduce false positives and approve trusted transactions faster with intelligent whitelisting and automated screening certificates.

04 — Payment Screening

Payment Screening

Take control of your payment flows with customizable screening rules that adapt to your business needs. Get real-time alerts, automated case tracking, and built-in watchlist checks to spot risks before they occur. Reduce false positives and approve trusted transactions faster with intelligent whitelisting and automated screening certificates.

05 — Account Monitorring

Account Monitoring

The customer journey in a single click. A Single Page View (SPV) of the customer history as per your organization’s requirement.

05 — Account Monitorring

Account Monitoring

The customer journey in a single click. A Single Page View (SPV) of the customer history as per your organization’s requirement.

An affordable zero code solution

Upgrade your compliance solution without the high cost of IT infrastructure and deployment. Just plug, configure, and scale as needed.

Easily customizable

Our modular platform adapts to your organization's unique policies and workflows. Whether you're updating processes or integrating new rules, Refineware lets you do it easily without disrupting business operations.

Innovation & Insight

Our dedicated in-house research teams continuously update the platform with the latest industry trends, regulations, and innovative practices - so you’re always in sync with evolving global standards.

Dynamic Dashboard

Instantly visualize any report using our zero-code, fully configurable dashboard. Customize views effortlessly to suit your organization’s unique needs.

Customer 360 view

Access a complete view of customer history and activity in one click. Make smarter decisions with a full understanding of each customer’s journey.

Case Management

Manage investigations, track actions, and coordinate internal communications all within a single unified workspace. Simplify case handling and improve collaboration across teams.

E-Document Control

Digitally issue, manage, and track internal policies, SOPs, compliance circulars, and agreements. Get acknowledgments and maintain audit-ready logs – all from one place.

How Refineware helps

Refineware’s dynamic, zero-code risk management tool allows risk monitoring easier for both individual and business customers. Institutions can easily build and adapt risk rules based on transaction patterns and customer behavior. Our system continuously monitors customer risk scores and updates them in real time using API integrations.

Onboarding corporates with layered ownership and complex structures is one of the biggest challenges for financial institutions. Refineware simplifies this process with a powerful, onboarding tool – designed to easily manage multi-level corporate hierarchies, beneficial ownership details, and ongoing monitoring.

Data visualization plays a crucial role in every aspect of business, which helps in faster insights and smarter decisions. Refineware’s zero-code dynamic dashboards let you customize your data visualizations to fit your needs. From customer profiles to transaction volumes and risk trends, it will help you gain powerful insights at a glance.

Reach out to us at Refineware to see how our compliance solutions can elevate your regulatory efforts. Visit our office or connect with us anytime via email or phone – we’re here to support your success.

Compliance made

smarter